The price of food increased 2.6% in April, the largest single-month increase since 1974, but food industry executives are insisting that the country has enough food. So why are prices going up?

The explanation provided by the industry is that consumers are buying more than they need, creating shortages.

But a shortage is not a good excuse for increasing prices. Contrary to what you might have learned in Econ 101, there’s only one reason for which a shortage should give rise to higher prices: profiteering, as I explain in a forthcoming law review article.

If shortage were the only explanation for these price increases, then the increases would need to be condemned.

Shortage Economics

Shortage is the state of demand exceeding supply at a seller’s initial chosen price. When that happens, the seller faces a problem: who gets to buy and who doesn’t? This is a problem of rationing.

There are two popular approaches to rationing. To ration based on the principle of first come first served, otherwise known as letting the good sell out. And to ration based on willingness to pay, otherwise known as raising prices until the volume demanded just equals the available supply.

Absent more, the fact that food prices jumped in April, combined with the existence of food shortages, suggests that the food industry has chosen the second option to deal with panic buying by consumers: to ration with price. Can you guess which of the two—rationing with price or letting goods sell out—is more profitable?

Why Econ 101 Gets Shortages Wrong

Econ 101, and defenders of industry, would like to tell a different story about price increases during a shortage, but the story they want to tell is not actually about shortage. According to Econ 101, when demand exceeds supply, prices rise because the cost of producing additional units to satisfy the new demand rises.

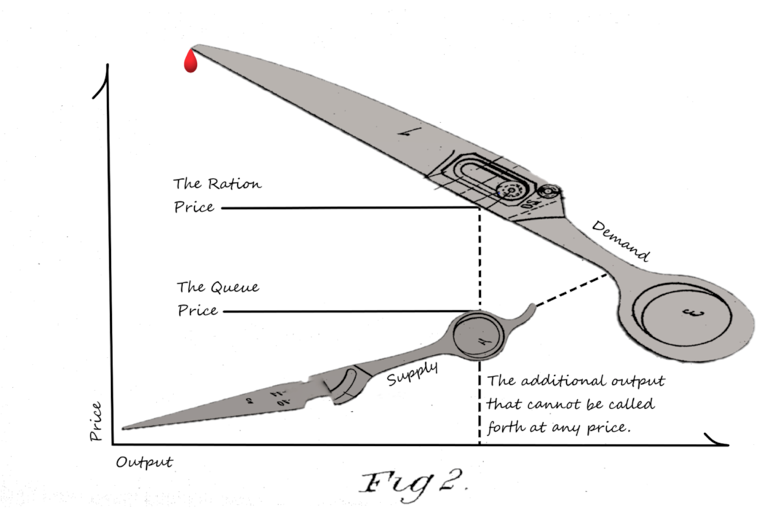

We’ve all seen Marshall’s famous scissors, with the upward slope of the supply curve reflecting the increasing cost of producing additional output (Figure 1).

The scissors tell a pleasant story: that price increases are productive, indeed, efficient, because they make possible the creation of additional supply with which to satisfy the excess demand.

The scissors do work just fine as a description of market equilibrium. But they don’t describe shortages, because shortages are by definition periods when price cannot equilibrate supply and demand. Shortages are what happens when the screw comes loose and the blades come apart (Figure 2).

In a shortage the seller doesn’t have enough stock to satisfy demand at the current price, and nothing the seller does, including raising prices, will make more goods magically appear. Which is why we call it a shortage. Supply is falling short.

That makes shortage a rationing problem, not a problem of equilibrating demand and supply. But that hasn’t stopped generations of free market devotees from trying to transform shortages into an equilibration problem, because shortages call into question the virtue of a sacred right: the businessman’s right to charge what the market will bear.

But Does Price Signal?

Really sophisticated economists–not the Econ 101 crowd–try to argue that rationing with price can still call forth more supply to end the shortage in the medium term, by sending out a signal to other firms, or even the seller itself, indicating that consumers would be willing to pay a high price if additional supply were to be brought to market.

That “price signal,” they say, causes firms to ramp up production. Which may well be true. But selling out sends just as clear a signal. A ration price tells the supermarket: you could probably sell more without having to reduce price by too much, so get more. Selling out tells the supermarket: you could probably sell more, even if you have to raise price a bit in order to cover the costs of getting more inventory, so get more.

Different signals, same effect. Even if ration pricing serves the useful function of signaling, selling out does just as good a job.

Why It’s Better to Sell Out

And selling out is better for America. Allocating supply to those with the greatest willingness to pay is the wrong way to ration, because that often means allocating supply to those with the greatest ability to pay, and we all know that ability to pay does not map well onto desert. The queue is more democratic. Early risers from all walks of life win.

Granted, queuing can be wasteful, if it means lost time waiting for stores to open in the morning. But as I argue in my article, we have the technological ability today to eliminate that kind of inefficiency.

Through online reservations systems. Many supermarkets already use these systems to run grocery delivery services, allowing consumers to queue for food online. But home delivery is expensive and therefore excludes precisely the groups that might benefit the most from queuing.

To the industry’s credit, however, supermarkets like Kroger have made access to curbside pickup free during the pandemic. Curbside pickup, which uses the same online ordering systems as home delivery, amounts to online queuing for in-store shoppers.

The industry should go further, to find even more innovative ways to minimize the cost of rationing based on first-come-first-served. And to explore even better ways to ration. Random lottery, anyone?

(If the thought of lottery-based rationing scares you, it’s probably because you’re used to winning that other food lottery every time. The one based on price.)

Is the Food Industry Gouging?

But are April’s food price increases really evidence of ration pricing? That’s a tricky question.

If price increases were driven by shortages, as the industry has ham-handedly suggested, then you would expect to see sales increase, as existing inventories sell out. But you would not expect to see costs rise, because in a shortage there is nothing firms can do to increase output.

But costs do seem to have risen along with sales, as firms have scrambled to pay workers a premium to induce them to show up to work during the pandemic. Walmart, the nation’s largest grocer, paid $800 million in bonuses to workers in the quarter ending May 1. Although Walmart’s revenues surged by 8.6% over that period, its costs surged too, by 8.7% across all business lines, including grocery.

Walmart also hired an astonishing 235,000 workers, many of whom, no doubt, were put to work picking grocery items from store shelves for home delivery and curbside pickup. That suggests that food price increases may be driven by new costs, including, in the case of curbside pickup, the cost of implementing a high-tech queue-pricing regime.

That doesn’t mean that the price increases do not also reflect some ration pricing. The 16.1% increase in egg prices in April stands out. But it does mean that “shortage” does not fully capture what is happening to food prices.

But what if it did?

The Law of Ration Pricing

State price gouging laws can reach some ration pricing. Consumers are already suing Amazon and supermarkets, for example, for violating a California law that kicked into effect when the governor declared a state of emergency in response to the pandemic.

But state price gouging laws are a patchwork. California prohibits gouging on “consumer food items,” for example, whereas Indiana prohibits only gouging on fuel. And these statutes tend to prohibit only large price increases–the threshold is 10% in California–rather than all price increases. But every penny charged above the queue price is profiteering in a time of shortage.

Another approach, which I describe in my article, would be to read antitrust’s consumer welfare standard to prohibit ration pricing whenever its existence can reliably be identified. Although courts tend to shrink from using the antitrust laws to prohibit pricing practices, as opposed to conduct that creates market power, there is a gaping exception: antitrust’s famous per se rule against naked price fixing.

A per se rule against clear cases of ration pricing would not be different in kind.

From Ration Pricing and the Pandemic to the Pandemic of Ration Pricing

But shortages, in the sense of demand exceeding supply, don’t only arise during pandemics. They are a common feature of virtually all markets, including online shopping, securities, commodities, real estate, and events markets, to name just a few.

In all of these markets, the screw comes loose from the scissors all the time. And sellers, unfortunately, almost always choose to charge ration prices instead of queue prices.

In the next installment in this two-part series, I explain why ration pricing—and the profiteering it implies—is a pervasive feature of our market economy, and why only the remoralization of American life may be able to save us from it.