This post is Part One in a two-part series exploring the possibility of a renovated “law and economics,” informed by newer, richer approaches to economic thinking. Read Part Two here.

***

In our experience and in that of others, left and progressive legal scholars tend to view arguments rooted in economic reasoning with a deep skepticism. This suspicion is understandable, given that law and economics was birthed by the foundations and political entrepreneurs of economic conservatism. Our empirical work on economics training for federal judges, summarized below, demonstrates just how sizable—and quantifiable—has been the conservative impact of law and economics.

Before getting to this evidence, though, we ask that “economics” as a whole not be conflated with the 1970s University of Chicago economics department – any more than legal scholarship as a whole should be conflated with the University of Chicago Law School faculty during that era. The empirical research we present in this post itself exemplifies how economics can be a powerful tool for examining (and not just assuming) the relationships between the formal structure of the law and the activities of economic exchange. As we lay out further in a subsequent post, legal leftists who fail to engage with the richness of academic economics miss out on many important insights.

For now, consider how the normative richness of modern economics contrasts with Chicago-style law and economics. In its most notorious form, economic analysis of the law has served to delineate portions of market activity as “off-limits” to legal and political interventions. Louis Kaplow argued against the use of distributional concerns in tort law, Richard Epstein held up unions as distortionary government-protected monopolies, and antitrust scholars such as Robert Bork and Richard Posner gave wide remit to firm behavior that might have been called “anticompetitive” in a previous era.

The prominence of these academic luminaries, while considerable in legal scholarship, has not been the most impactful achievement of the law-and-economics movement. Instead it was the training and involvement of judges (complemented by the academic achievements) that proved the most profitable gambit. In particular, Henry Manne’s Economics Institute for Federal Judges has had a sustained impact on judicial policymaking in the federal courts.

Our empirical work (with Daniel Chen) on the Institute demonstrates the effect that attending the “Pareto in the Pines” had on federal judges. Beyond the 2-week economics instruction, judges were brought into a conservative intellectual network. Adjusting for the factors that predict attendance (and exploiting the fact that judges are randomized into cases), we find that subsequent judicial decisions on economics topics became more conservative (according to Donald Songer’s hand-coded data). In particular, the Manne judges ruled more often against the federal government in regulatory cases, and they used more economics language to defend their decisions. Further, district judges trained in economics increased criminal sentences, consistent with the use of more “deterrence” reasoning.

The success of the intellectual project is further illustrated by spillovers across judges. We find that Manne-trained judges serving on three-judge panels influenced the co-panelist judges, who wind up taking up simplistic versions of economics ideas (which could be called Econ 101-ism) in their own subsequent written opinions.

Producing statistical evidence on judges requires quantitative measures of their behavior. To understand the role of economics in judicial decisions, we constructed a measure of economics reasoning from the authored opinion texts. This measure summarizes the similarity of judicial language to a set of terms identified by Robert Ellickson as distinctive of law and economics scholarship. The word cloud shows the terms that are closest in a computational linguistic distance (more precisely, cosine distance between word embedding vectors estimated using word2vec) to the words in Ellickson’s list, with size proportional to closeness.

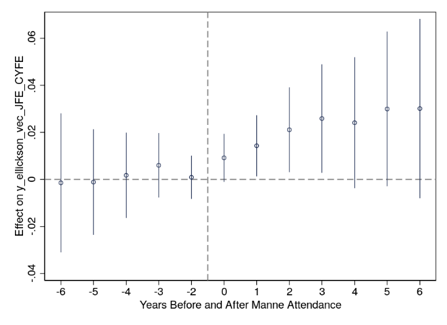

To probe the efficacy of the Manne program, we ask the basic question of whether judges who attended the program (between 1976 and 1999, when the program ended) used more economics reasoning in their subsequent written opinions. The graph shows that, indeed, the use of this language increased in the six years after attendance, relative to the six years before attendance. The statistics for this graph include controls for judge and court-level factors.

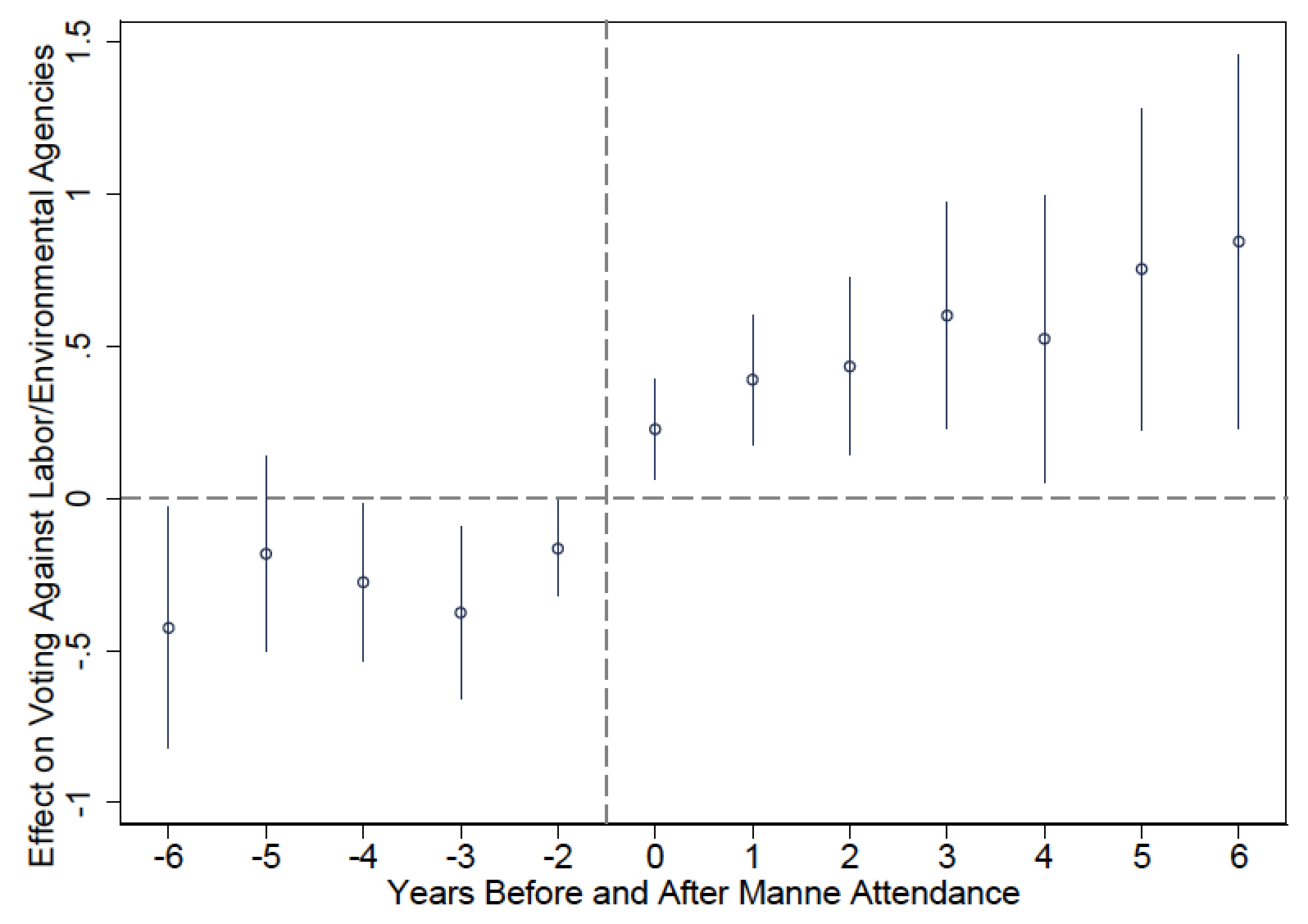

As another example of the results in the paper, we show in the second graph the effect of Manne attendance on rulings against the National Labor Relations Board and Environmental Protection Agency. We can see that this conservative vote tendency increased after attendance. The Manne program therefore had a real-world impact on policymaking by these judges.

These effects are the natural outcome of a conservative, interpretation of the law based on idealizations about how markets work. On this view, the law reflects, and should reflect, a tendency towards economic efficiency, to the exclusion of other social or legal factors. The definitions of the firm and of property are seen as results from economic theory, rather than as institutions constructed by law. Judges are encouraged to think of their role as getting out of the way of entrepreneurs—those job creators and consumer satisfiers who enrich the market and whom the market enriches.

Proponents of this view have deployed Econ-101-ism across various domains of law: Coasian delineations dominate active, pre-emptive regulations, so that private torts are expected to efficiently deter negative externalities; obviously fat-and-mean monopolies in product markets are in fact in the consumer interest; minimum wages, mandated benefits, and union empowerment will ultimately hurt their intended beneficiaries. One can find the full range of Hirschman’s “Rhetoric of Reaction” in the early law and economics movement, where economics is used to explain why the market will render pro-social measures as futile or even perverse. This brand of conservative law and economics has swayed the courts, the agencies, and (to a lesser extent) the law schools. A number of highly profitable consultancy firms have been built in the process.

Econ-101-ism takes too seriously the simplistic supply-and-demand view of the market—guided by the benevolent invisible hand—that was dominant in economics in the 1970s and 1980s (i.e., Chicago Price Theory). Meanwhile, the broader economics community has moved far from these themes. It has become normatively more pluralistic, admits the importance of many other social institutions besides “markets”, and has a rich vocabulary for criticizing soi-disant laissez-faire. In our next post, we will discuss some strains of research that, when drawn together, could form an arsenal of critical concepts for economic analysis of law and the legal system. These concepts might be deployed to enhance economics pedagogy for students of law.