Most years, I teach an introductory course on International Trade Law. And every year since I began I’ve included a session on the international financial architecture, on the view that this architecture is intimately bound up with the functioning of the trade regime.

I begin the course predictably enough with a series of sessions on the history and political economy of international trade before we get into what I call the “guts of the GATT.” Here, we study the key articles of the General Agreement on Tariffs and Trade (GATT) and the main disputes that have arisen concerning their interpretation, both before and after the establishment of the World Trade Organization (WTO). Any course on international trade law would have to introduce core elements such as “most favored nation” status (Art. I), “national treatment” (Art. III), key exceptions (for example, as elaborated in Article XX), and the main “annex agreements” of the WTO (such as the TRIPS agreement, which Amy Kapczynski has discussed on this blog), as well as the various remedies and safeguards available to states facing disruptions from international trade. But toward the end of the course, I bring my friend and colleague, Robert Hockett, to discuss the international financial architecture underpinning economic globalization as a whole.

I suspect few international trade law courses address international finance as an integral part of an introduction to trade liberalization. Given the evolution of international economic law, this choice is probably unsurprising. Neither in the treaty text of the GATT (nor in the other “annex agreements” that make up the WTO) is financial architecture explicitly regulated. By contrast with international trade law, international financial law is elaborated through a different set of governing texts, institutions, and international monetary practices—prominently, the IMF Articles of Agreement, the IMF itself, and the practices that have developed among affiliated national central banks and finance ministries. Trade law scholars may be understandably wary of bringing such complex or seemingly extraneous considerations into a course that will already be full enough.

The problem with abstracting away from such matters, however, is that trade law thereby slips into modeling international trade as if it were barter. After all, the trade in goods and services that the GATT/WTO liberalizes is a money-mediated trade, in which currencies play an essential role in cross-border flows. This is a simple enough point to make, and it could seem possible, accordingly, to ignore it in any discussion of international finance. (A similar point might be made in connection with contemporary economics courses, which tend to abstract from money and finance – as though domestic exchange could be modeled on barter as readily as can cross-border exchange.)

But the rub comes when students ask questions such as: how can the United States run persistent trade deficits year after year? What is it that the U.S. gives in return for its excess of imports if trade isn’t barter? And why do its trading partners accept it, whatever it is?

Sometimes these questions are prompted by headline news such as the outcry this week that the 2017 US-China trade deficit is now the highest it has ever been, with the U.S. importing about $375 billion more in goods and services than it sells to China. Country-specific trade deficits, like the US-China deficit, may matter for particular industries, sectors, or regions, and for geopolitical reasons. But bilateral deficits need not be a cause for general, worldwide concern as is sometimes assumed or alleged. A country can have a trade deficit with one country along with surpluses with other countries, with which the surplus country runs deficits; thus, there can be a balanced mix of global trade with many country-specific variations. That is indeed part of the point of an international monetary regime: among other things, it enables nations to be in balance “with the world” even when they are out of balance with individual trading partners – something that would be rather difficult, if not practically impossible, to effect via barter.

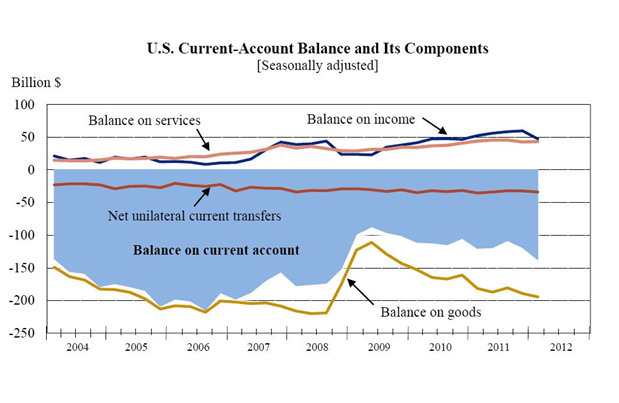

But the graph below shows the U.S. current account balance in the post-war era with all countries, in aggregate, which indicates a different sort of problem from country-specific trade deficits.

What is shown is that the U.S. has a persistent global trade deficit – meaning more imports than exports in relation to the whole world. Now someone might reasonably ask, what is it that the U.S. is “trading” with all the other countries?

A “trade deficit” or, more precisely, “current account deficit,” has a flip side, by definition – what is known as a “capital account surplus.” What this means is that a deficit in the current account the U.S. has with the rest of the world is made up by a “surplus” that the U.S. runs in its capital account, making up the difference by sending capital abroad in exchange for goods and services imported from abroad. In effect, the U.S. “trades” claims upon future goods or income from the U.S. – that is, financial instruments – for the “current” goods that it imports now.

What the U.S. mainly sends abroad in exchange for the goods and services it imports is thus not a different basket of goods and services reflecting its comparative advantage, as my students learn would be the case in the idealized model of barter-style trade going back to David Ricardo’s famous example of wine and wool. Neither is the capital account surplus made up of specific investments in particular productive projects. The U.S. does, of course, send a lot of goods and services around the world, and many foreign investors are keen to purchase American real estate, companies, and other assets.

But what makes up this persistent and long-running current account deficit is mostly U.S debt. The main form that this debt takes is bills from the U.S. Treasury, now accumulated abroad in the trillions of dollars, held by many different institutions but primarily foreign central banks. About a fifth of foreign-owned U.S. debt is held by China, currently the largest foreign owner of U.S. debt at an estimated $1.2 trillion, with Japan close behind with an estimated $1.1 trillion.

Now we come to the heart of the matter, and why international financial architecture should be part of a course on the laws governing global trade. Why is it that foreign central banks want to accumulate these dollar-denominated IOUs?

The U.S. dollar functions as the de facto reserve currency of the world. It is the currency in which many if not most international transactions are mediated – sometimes, as with OPEC, by express agreement—and which countries accordingly accumulate, not just for use in the United States, but for use with other countries. This de facto status follows on the de jure status that the U.S. dollar enjoyed under the post-war Bretton Woods arrangements, prior to 1971, when foreign currencies were formally traded at fixed amounts of dollars, and the dollar was pegged to gold.

The key thing to recognize is that under either the initial Bretton Woods arrangement (the dollar-gold peg) or under the current de facto reserve currency arrangement, the supply of U.S. dollars must do more than mediate transactions within the U.S. economy; it must also lubricate the growth of the globalized world economy as a whole. Countries that do not use dollars domestically nevertheless need to accumulate them to perform many operations—and with countries other than the U.S. This means, too, that the dollar (and dollar-denominated debt) is seen as a safe asset to the extent that it will be valued by many parties both within and outside the United States.

The trouble with this arrangement is that it effectively requires the U.S. dollar to perform two roles – two roles that can end up at crossed-purposes. On the one hand, it remains the fiat currency for the U.S. economy, meaning the U.S. central bank – the Fed – employs it for purposes of Keynesian macroeconomic smoothing, varying the money supply to stimulate or moderate U.S. economic growth. But, on the other, the dollar supply also affects growth in the world as a whole, given the dollar’s global role. Thus, if world growth rates exceed U.S. growth rates, the global demand for dollars will outstrip what the U.S. would ordinarily supply. The U.S. is then faced with the choice of holding back global growth, in order to preserve the dollar as an instrument of domestic monetary policy, or turning on the taps and allowing the world to grow, but at the expense of relatively loose monetary policy at home – which, as we’ve painfully learned, can fuel asset price bubbles.

As Hockett shows, the U.S. has generally resolved this dilemma by favoring global growth—and with it, those industries at home, such as finance, that are best positioned to take advantage of it. But the consequences of this choice include deindustrialization, the financialization of the American economy, and a persistent tendency to boom-bust cycles, given cheap money. And to come back to trade law, trade liberalization will disproportionately bring foreign goods and services into the United States in exchange for what the U.S. now “specializes” in internationally: providing the money that a globalizing economy requires in the form of dollar-denominated debt.

Arguably, this arrangement has not been altogether bad for the U.S.: it has allowed consumers to consume far in excess of what they might otherwise, disguising flatlined wage growth since the mid-1970s by increasing real purchasing power through imports. But massively increasing indebtedness, persistent financial instability, and rising inequality may all be complex consequences of this international economic arrangement.

In another post, Hockett and I will explore what might be done about this problem. But it is worth noting by way of conclusion that this situation was not unanticipated. Prominent Keynesians (indeed, Keynes himself) well understood that the country that provided global liquidity would face these problems—and even warned the U.S. about it during the Bretton Woods negotiations. What Keynes and his fellow British delegates at Bretton Woods proposed instead was, in essence, a separate currency for international transactions that would spare the dollar its dual role. That solution—and what we might make of it today—will be the subject of the later post.

But to return to the pedagogical point: perhaps where a course on international trade law can go is no further than identifying this problem and its persistent non-solution. Institutionally, if not analytically, there are no widely accepted answers yet to the puzzle of how to produce a sustainable international economic system and an equitable financial architecture. It remains debatable, or at any rate debated, whether these arrangements are a problem at all – and whether it would be possible to sustain a global economy anchored in anything other than dollars (and thus dollar-denominated debt).

But I hope that introducing these dynamics provokes my students: makes them think, makes them curious, even frustrated or worried. And that it helps them recognize that our trading arrangements are rooted in more than the legal texts we read, and that it is untenable to try to understand these arrangements without grasping the broader financial structure in which global trade today is necessarily enmeshed.